My trading rules are an amalgamation of several professional traders - Chris Lori, Rob Booker, and Mark

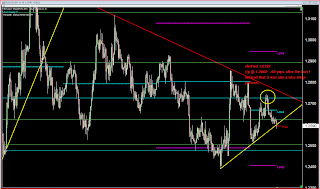

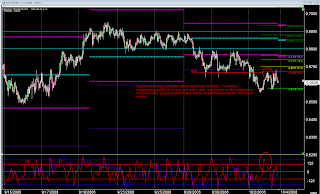

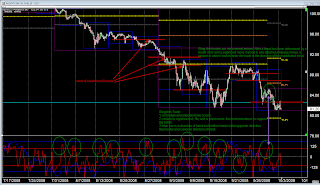

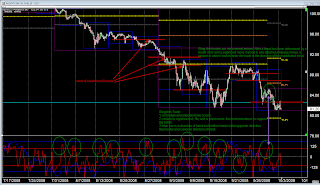

Braun. Support and resistance (s/r) is the cornerstone of my trading. Or more specifically, s/r that is determined by price. Fibonacci (fibs) and Weekly Pivot Points are also used as s/r, but they are secondary to price. My focus is trading on a retest of a determined s/r area and NEVER the break out. I enter a trade when most traders would feel the most uncomfortable, right into a bold faced candle moving in the opposite direction. Most of the time price consolidates then breaks out, moves to another area, then consolidates. In the past, when I traded the breaks, once price broke out and closed beyond an established s/r area, I would enter a trade and get stopped out or my stop loss would be to great to justify my entry. Once I learned that price spends most of the time consolidating I started trading

retracements, either at a major price s/r level or an area where different levels of s/r occurs (i.e fib, pivot, and s/r clusters) which I call the "Slingshot Strategy". This is just a "simple" explanation of my trading rules. I can not possibly explain every nuance here. It will come with every chart I post. So thank you for reading this, good luck with your trading and be careful out there.