Tuesday, December 22, 2009

Thursday, November 27, 2008

gbp and cad trades

Sentiment has changed a bit for the dollar. Whether its end of the year squaring (deal desks are thin) or traders are less risk averse, I noticed that the dollar was giving up its gains i.e. higher highs and higher lows on gbp, euro, etc. And as usual, I waited for a pullback before entering on a long gbp/usd. I chose to enter on a retest of recent highs as opposed to waiting for a deeper retrace (fpp). It did pay and thats the point, to make money! On the usd/cad I scored a few points off of that, but the usd/chf did not follow suit. The pullback was too far and took out my stop before moving off of my level

Wednesday, November 19, 2008

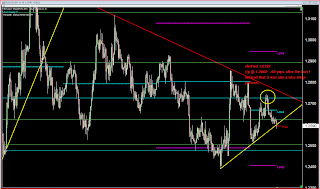

eur/usd 60m long 1.2512

I stuck with a level that I speculated price would breach. I noticed another level that was deeper, of course hindsight is always 20/20 and I would have gotten a better fill. Oh well, I am up a few pips right now. Looks like I am on target to hit p/t.

update... booked 25 pips. very dollar bullish. pattern took a long time to develop, that tells me that there may be another leg down.

update... booked 25 pips. very dollar bullish. pattern took a long time to develop, that tells me that there may be another leg down.

Tuesday, November 18, 2008

s/r and trendline cluster

Nice little cluster of s/r and a trendline. I had no intention of trading this because for me I need more of an argument. From my testing, setups where I wait for obvious fpp's have paid consistently and extremely quick. The candles usually "explode" off of these levels. Maybe in the future I will build the confidence to trade clusters like this, but for right now I'll just pass on it.

Monday, November 17, 2008

eur/usd 60 min short

Just another euro short that paid 60 pips. Found nice FPP resistance at 1.2722. Price hit me while I was asleep. Target was back inside of the range. As am writing this post the pair has dropped +120 pips from entry. I did not enter with my "runner", but it's not a big deal. Since my understanding of FPP, my levels for s/r has been incredible. My backtesting has also been stellar. My levels most of the time will have a less than 10 pip drawdown. Awesome.....

Saturday, November 15, 2008

eur/usd short at 1.2505

Here is a short I made on the euro at 1.2505. Pretty self explanatory but as you can see I have completely weened myself off of all indicators. Support and resistance is my bread and butter and I just want to focus on that. Although I spotted more trades this week, for whatever reason I did not take it. I have been really backtesting my s/r trades and after a little adjustments to how I cherry pick my s/r levels (thanks to my friend Steve W.), my trading and confidence has taken off. My focus is now on s/r, but more specifically areas that I am tentatively calling a Fractal Price Pivot or FPP. Simply put, it's an area where price tugs and pulls at, usually within a fractal. Another trade I am also tentatively calling an Apex Trade. This is exactly what it sounds like, I look for major areas where price pivoted and as price approaches the apex of the pivot, price will usually bounce at these levels. Many time it's where complete reversals occur. I am still utilizing fibs, weekly pivots, and chart patterns, but I will use it when there is a confluence with major s/r area, FPP, or apex. I' ll include several other snapshots.

ll include several other snapshots.

ll include several other snapshots.

ll include several other snapshots.

Saturday, October 4, 2008

aud/usd daily - slingshots can be found on every time frame

Subscribe to:

Comments (Atom)